The Biden Administration’s Inflation Reduction Act (IRA) is now celebrating its second anniversary. Signed into law on the 16th of August 2022, the IRA aimed to enhance energy security and fund climate change programs. It mobilised USD369 billion for these purposes over a decade, stretching to 2032. The funding mainly comes in the form of federal production and investment tax credits and grants, with the aim of onshoring domestic production capabilities. Since 2022, the scheme has successfully attracted over USD110 billion of investments into the EV and battery sectors.

EV Sales

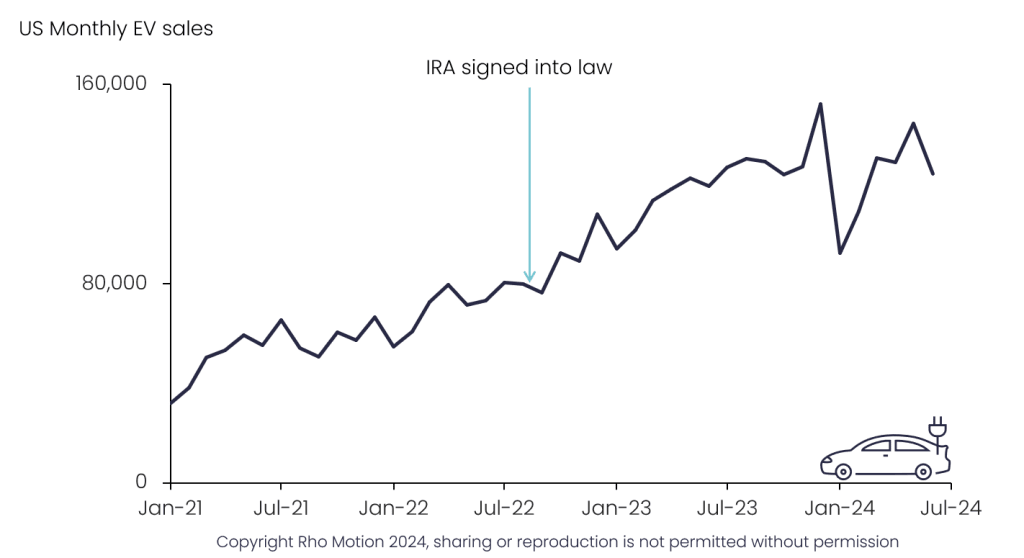

One of the most visible benefits consumers have felt from the IRA is the 30D clean vehicle consumer tax credit, offering up to USD7,500 for new EV purchases, and the 25E credit, providing up to USD4,000 for second-hand EVs. In the first half of 2024, the IRS reported spending USD1 billion to support the sales of over 150,000 EVs (125,000 new and 25,000 used). There’s no doubt that these tax credits, implemented since August 2022, have played a pivotal role in accelerating EV sales across the US. In 2023, EV sales increased by over 55% from the previous year, reaching more than 1.4 million vehicles.

Investment Landscape

Since the IRA’s launch, it has attracted investments totalling more than USD215 billion across the battery, EV, renewable energy, and nuclear energy sectors. Of this, over USD110 billion has been channelled into the EV and battery sectors. The battery industry, in particular, has seen the largest share, with nearly USD64 billion invested across 34 gigafactory projects, focused on producing cells, modules, and packs. In 2023, Benchmark Mineral Intelligence estimated that the US battery capacity pipeline through to 2030 has equalled, if not surpassed, that of Europe.

Downstream, an additional USD22 billion in investments has been announced for mining operations and the production of cathode and anode materials essential for batteries. The EV sector has seen 68 projects for vehicle assembly, production, and component manufacturing, totalling USD21 billion, underscoring the success of the US in onshoring its EV industry. Smaller but significant investments have also been made in the battery recycling and charging infrastructure sectors.

Investment numbers and sales figures do not tell the whole story

While the volume of investments and sales figures demonstrate the IRA’s success in attracting capital, these numbers do not tell the full story. In the first half of 2024, 17% of all EV sales were subsidised by the federal government.

Since January 2024, the IRA introduced stricter criteria for vehicles to qualify for the full USD7,500 tax credit. For instance, 60% of the value of battery components must now be produced or assembled in North America—a threshold that will gradually increase to 100% by 2029. Additionally, 50% of critical materials must be sourced from the US or a free trade agreement country in 2024, with this requirement rising to 80% by 2027.

Before these changes, a broader range of EVs qualified for federal subsidies, but as of 2024, only 22 out of 105 models on the US market are eligible. This shift has led to a dip in monthly sales in January 2024. While the 30D tax credit has undoubtedly supported EV sales, its impact is somewhat limited by the reduced number of eligible vehicles.

Regarding the investments, a recent Financial Times investigation revealed that about 40% of the largest projects under the IRA and the Chips and Science Act have been delayed or paused. This includes facilities across the EV, battery, clean energy, and semiconductor industries. Nevertheless, most facilities remain on track. Shifting market demands have left some companies uncertain about the timing of market entry and when to bring facilities online, but this is not limited to the US, with facilities in Europe also experiencing delays.

Rho Motion’s Evaluation, IRA’s Success and Future Challenges

The IRA has largely succeeded in its initial aim of attracting investments and onshoring the manufacturing of key industries. However, China’s dominance in many sectors remains a significant challenge. While many companies have adjusted their supply chains to comply with IRA requirements and qualify for tax credits, others have found it too costly to make such changes. In some cases, even with the tax credits, production costs in the US remain higher than in China, which continues to offer lower prices. To address this, the US has recently introduced a draft of tariffs aimed at levelling the playing field.

Domestically, for the success of the announced IRA investments, there must be sufficient demand for the products they will generate, most notably EVs. Currently, EV penetration in the US sits at around 10%, but this will need to grow significantly to ensure the sustainability of these new facilities.

While the US remains far behind China in terms of EV and battery manufacturing capacity, the IRA has undoubtedly ignited growth in the US clean energy sectors. The industry has momentum but must face ongoing challenges in the global market as well as other domestic political uncertainties.

More information

For more information on how our research can support you, get in touch.

Image Credit: Adobe Stock

Sources: FT, energy.gov, home.treasury.gov

Back to News

Back to News